The best companies tend to increase their profits over time, and investors reward these greater earnings with a higher stock price. By Martin Baccardax. Short selling is risky. At NerdWallet, we strive to help you make financial decisions with confidence. You can simply walk into just about any corner bank and purchase mutual funds or bonds on the spot. Compare Investment Accounts. To name a few examples of what this could mean:.

Investment Banking For Dummies

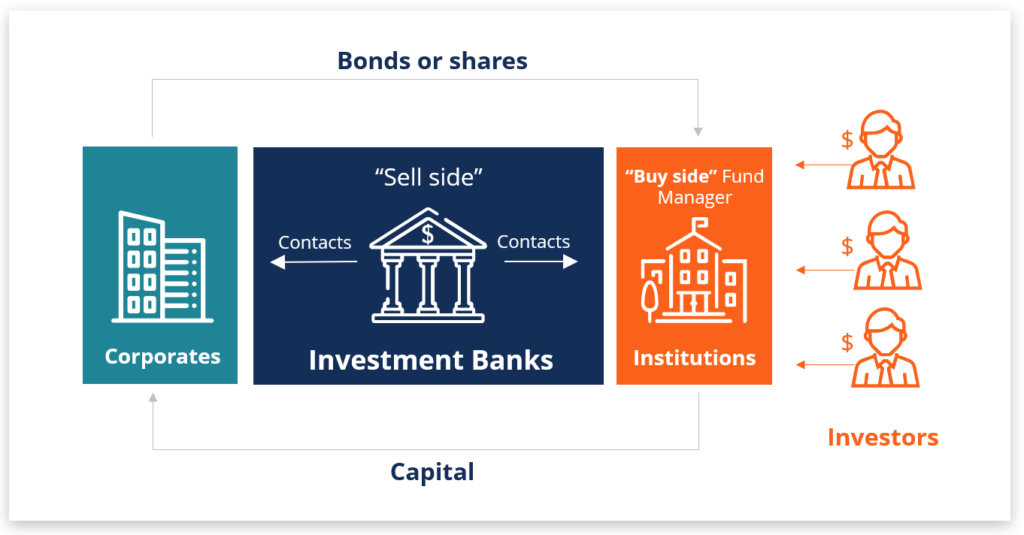

By Matt Krantz, Robert R. Investment banks make most of their money helping companies and governments raise money by selling securities. But most important, the investment bankers act as middlemen between buyers and sellers. Investment bankers not only help the sellers prepare securities to be sold, but also interact with potential investors. One of the great values offered by investment bankers to their customers selling securities is their ability to find buyers. The fees, generated by underwriting securities, only materialize if there are ample buyers to soak up the stock being offered.

1. The reasons you bought the stock no longer apply

One way to make money on stocks for which the price is falling is called short selling or going short. Short selling is a fairly simple concept : an investor borrows a stock, sells the stock, and then buys the stock back to return it to the lender. Short selling is risky. Going long on stock means that the investor can only lose their initial investment. If an investor shorts a stock, there is technically no limit to the amount that they could lose because the stock can continue to go up in value.

Stock Market Buy & Sell Strategies For Financial Independence — Is It Time To Sell?

Treasury Bonds. Open Account. Penny Stocks. Follow him on Twitter to keep up with his latest work! How to Make Money Investing in Stocks. Speculators short sell to capitalize on a decline while hedgers go short to protect gains or minimize losses. It’s hkw a bad idea to sell stocks simply to lower your taxes. When a company like Disney or Exxon has a good financial quarter, they’ll reward shareholders with a dividend. Short selling comes involves amplified risk. There are two main situations where this might be necessary. Quant Ratings. By Tony Owusu. Stock Trading. Home Insurance. Bancorp has resolved to return more than 80 percent of capital to shareholders in the form of dividends and stock buybacks each year. Short selling is not a strategy used by many investors largely because the expectation is that stocks will rise in value.

No comments:

Post a Comment