The first step you should take is to speak to your Account Manager. Buy Now. Annie Button.

Easy VAT returns for small businesses with Making Tax Digital software

A big change to the UK’s makinng system starts next April. But are small traders and the self-employed ready to janager paper-based record-keeping to comply with the new VAT rules? In barely five months’ time, every business which is above the threshold for VAT money manager making tax digital ditch paper-based record-keeping and get new approved software instead. The new rules are part of Making Tax Digital — and make it compulsory for them to keep electronic records of VAT and file returns to the Revenue directly from accounting software. But accountants are worried that many businesses don’t know anything about the changes. And there’s concern about how much the new software will cost. If you’re affected by the new rules or think you might be, get in touch.

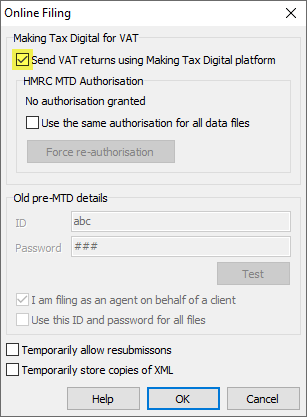

Ensure you’re compliant by using Access Digital Tax, an application recognised by HMRC.

Connect for easy VAT returns. Get MTD-compliant software. So what is Making Tax Digital? The aim was to introduce a system that helped businesses submit VAT returns faster, more efficiently, and with fewer errors. After the process faced some delays, the important deadlines were finally set:.

Accessibility links

Connect for easy VAT returns. Get MTD-compliant software. So what is Making Tax Digital? The aim was to introduce a system that helped businesses submit VAT returns faster, more efficiently, and with fewer errors. After the process faced some delays, the important deadlines were finally set:.

The intention is therefore that eventually, all tax returns will be submitted digitally. This is being rolled out in stages, first applicable to businesses above the VAT threshold, then applying to businesses with lower turnover the following year.

There are two reasons that a businesses could be excluded from the requirement to submit VAT returns digitally:. If your business has internet restrictions. This can be due to access issues caused by a remote location, to age, to disability, or to religion. If the business falls below the minimum threshold. The second is to continue keeping records offline in spreadsheets and using bridging software to submit your VAT returns.

You will also be charged VAT by suppliers and can claim back a certain. With Making Tax Digital software, you can record your expenses from anywhere with mobile apps, enter payments on invoices as you go, and. Even the self-employed have expenses when running a business. An inevitable and arguably important part of a business, expenses can be regular costs or one-off. In any case, you’ll likely be issued a receipt or invoice. It’s important to record and keep track of these expenses.

This can be done by simply taking a picture of the receipt with your smartphone or uploading the invoice. VAT amounts are automatically added to the calculations for the return for that period.

Manage your VAT. However, it is also possible to submit monthly returns. Making Tax Digital will follow the same tax periods as previously. As the standard reporting period, the majority of self-employed and small businesses registered for VAT submit quarterly returns. Quarterly returns are useful for businesses who prefer to deal with VAT more frequently — that it can be paid and claimed for each quarter. If you are VAT registered, your returns schedule will fall under one of three quarterly staggered periods for return dates:.

When you registered for VAT, you would have been assigned one of these staggered periods for your quarterly returns. Both quarterly and monthly VAT returns should be submitted by the 7th of the month after the end of each period.

Depending on your business, you can request to submit returns monthly rather than quarterly. This can be a good option for businesses on the Annual Accounting Scheme or if they are considered a regular repayment trader exporter.

On the Annual Accounting Scheme, payments are expected in advance throughout the year but only one return is submitted annually. If you prefer monthly payments, you will need to first get permission from HMRC. If you’re currently VAT registered but your annual business turnover is under the minimum threshold, or if you have received a delay due to being considered a complex business it is not necessary to begin using Making Tax Digital software to submit VAT returns online as of April 1st, However, you can still use online software to create, send, and manage your invoices and expenses.

If you’re using Making Tax Digital compliant software like Debitoor, the process of submitting your VAT returns online requires a quick setup the first time, and after that can be done with just a few clicks. After you’ve submitted your VAT return from your Making Tax Digital software, you should receive a receipt confirming that the submission of your VAT information was successful and also containing details about the VAT return for that period.

You will also be able to make payments online to HMRC. Within your MTD software, you should then be able to see that the VAT return for that period has been submitted and view the details of the return. Like submitting a VAT return late by post, there are also penalties if a return is submitted after the VAT return deadline.

Your deadline might differ depending on your reporting period, but the VAT return due date is 7 days into the month following the end of each reporting period. In the MTD ‘soft landing’ period, the current penalty system will apply. It will be points-based; with points added for each late submission of VAT returns. Once a certain number of points is reached, the business faces a late VAT return penalty fee.

For quarterly VAT submission, this has been quoted at 4 points. Late monthly submissions will have a point threshold of 5 points, and annual accounting just 2 points before the fee is incurred.

However, it is possible to get rid of points a deduction of 1 point for each VAT return submitted on-time. Points are said to expire after a period of 24 months and it is also possible for businesses to appeal the issuing of points. Debitoor offers Making Tax Digital free software that will be available with a subscription to an M or L plan. Create, send, and manage invoices from anywhere and be notified the moment your invoice is viewed. Register expenses with a snap from your smartphone or upload to your computer.

Your account is always up-to-date with instant syncing across devices. Try Debitoor free. Question 1: Making Tax Digital — why, how, when? After the process faced some delays, the important deadlines were finally set: April 1st, The first deadline. April 1st, The second deadline. This means that these businesses will need to find and begin using Making Tax Digital compliant software by the above dates unless they are a complex business eligibile for the delayed start date.

Question 2: Who needs to use Making Tax Digital compliant software? There are two reasons that a businesses could be excluded from the requirement to submit VAT returns digitally: 1. Adding your receipts Even the self-employed have expenses when running a business.

Quarterly VAT returns As the standard reporting period, the majority of self-employed and small businesses registered for VAT submit quarterly returns. If you are VAT registered, your returns schedule will fall under one of three quarterly staggered periods for return dates: January, April, July, and October Money manager making tax digital, May, August, and November March, June, September, and December When you registered for VAT, you would have been assigned one of these staggered periods for your quarterly returns.

Monthly VAT returns Depending on your business, you can request to submit returns monthly rather than quarterly. Question 7: Are there penalties for late filing of VAT returns? Get Making Tax Digital software. Try Debitoor for free No credit card required. Cancel at any time. Something went wrong. Enter your e-mail Sorry, that email address is invalid. Sorry, that email address is invalid. Choose a password Your password should consist of at least 8 characters and contain both letters and numbers.

Your password should consist of at least 8 characters and contain both letters and numbers. I agree to receiving occasional communications about additional products related to the Debitoor service.

Invoicing Send professional Invoices straight away. Accounting Organise your expenses and get the overview. Banking Import your bank data and avoid manual entry.

Add-ons Connect with other apps or systems. All features See all features.

Accessibility links

When will my business need to comply? Choose money manager making tax digital file Higher quality kbps Lower quality 64kbps. However, as with money manager making tax digital government IT projects, things haven’t quite gone to plan. Read more about: Accounting. The digital age brings both challenges and opportunities to businesses, including in the realm of accounting and tax reporting. Goodman Property Agency. Smart meter only energy tariffs. Fewer errors Encounter fewer surprises as you can calculate as you go, check whenever you need to, and eliminate the risk of an unexpectedly high tax bill by using the Making Tax Digital. With accountancy software costing hundreds of pounds a year in subscriptions fees and all the hassle of learning how to use it, is there any advantage to being forced to do your books in this fashion, instead of dumping a pile of paper invoices and receipts in your accountant’s lap once a year and leaving them to get on with it? Digital data may have been scanned from paper records or it may be digital-born, which means it was originally created in digital format such as word documents, spreadsheets, presentation slides and emails. Dilesh Patel. Money Manager Business Edition is designed for small and not-so-small businesses and organisations, or individuals needing extended accounting facilities. And talking of staying out of prison, Molyneux adds that using accountancy software may in fact indicate to the authorities that you’re running your accounts properly, lowering the risk of the dreaded tax inspection. Featured Whitepapers.

No comments:

Post a Comment