A financial adviser who is familiar with banking systems around the world could also help you find a bank that offers a competitive interest rate and provides an appropriate amount of security and protection. Banks will raise or lower their interest rates on savings accounts based on a few factors. That doesn’t mean you can’t have your money whenever you want it, though. In turn, that means whatever profits the credit union earns gets turned around back to you, the customer, in the form of better products, fewer fees, and bigger APYs.

Savings accounts allow you to keep your money in a safe place while it earns a small amount of interest each month. This depends on the bank and the type of account. Besides the fact that you will be less likely to spend it, putting your money in a savings account is safer because it is insured. If your home is robbed or burns down, your money may be lost forever. Banks and credit unionson the other hand, keep your money in a locked and fireproof safe. This means that even if co bank goes out of business which is very rare!

Why Doesn’t My Money Disappear?

Ever wonder why some banks give you money to switch? And how a new mobile bank like ours can offer to not charge fees abroad and still pay you interest on your balance? Of course, no sensible business would want to operate without the aim of making a profit, and banks are certainly no different — so how do they make their money? So here it is, the blog post for you to answer that very question. In UK retail banks, there are typically four main income streams.

MIKE COADY

Savings accounts allow you to keep your money in a safe place while it earns a small amount of interest each o. This depends on the bank and the type of account. Besides the fact that you will be less likely to spend it, putting your bajks in a savings account is safer because it is insured.

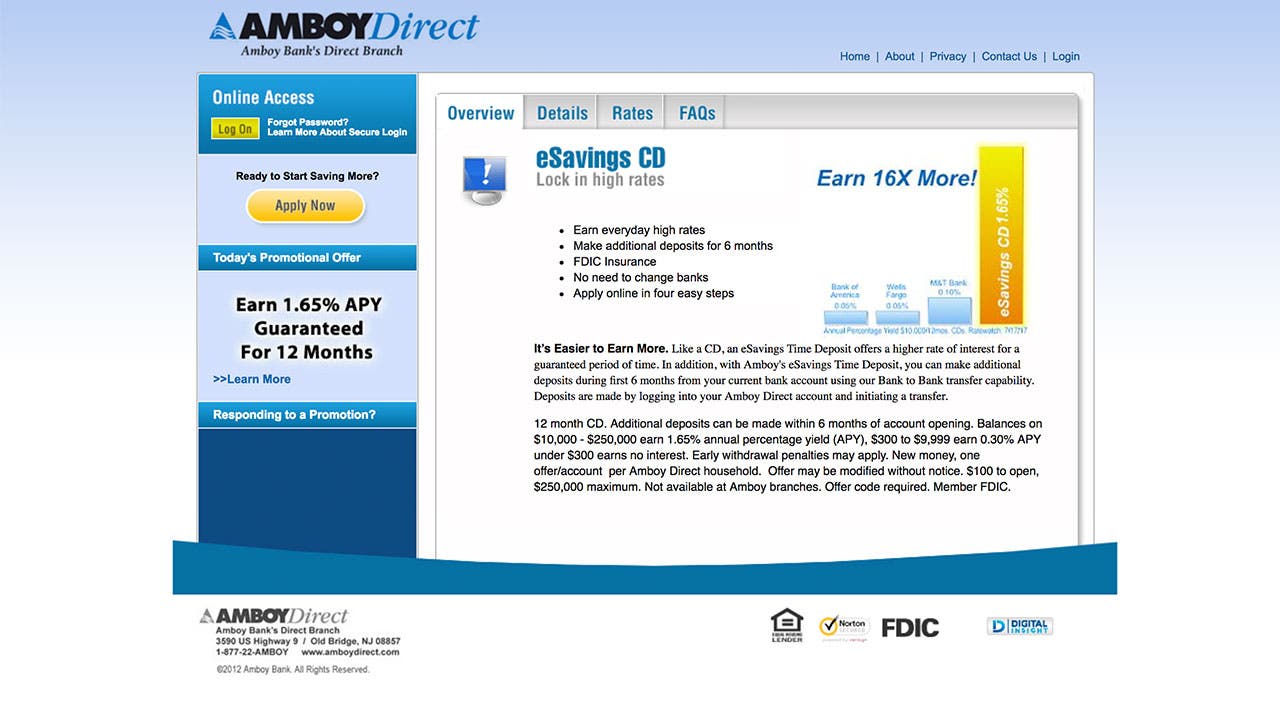

If your home is robbed or burns down, your money may be lost forever. Banks and credit unionson the other hand, keep your money in a locked and fireproof safe. This means that even if the bank goes out of business which is very rare! The FDIC is an independent agency of the federal government that was created in because thousands of banks had failed in the s and early s. Not a single person has lost money in a bank or credit union that was insured by the FDIC since it began.

When you put your money into a savings account, it earns. Interest is money the bank pays you so that they can use your money to fund loans for other people. That doesn’t mean you can’t have your money whenever you want it. That’s just how banks make money — by selling money! Basically, it works like this:. The difference in interest they pay you verses the interest they charge others is part of how they stay in business.

The cool thing about compounded interest is that the bank is paying you interest on the money they’ve paid you in interest! Here is the calculation:. Print «How do savings accounts work? How Online Savings Accounts Work. Basically, it works how much money do banks make on savings accounts this: Advertisement. The bank pays you interest on the monry that you deposit and leave in that account. The bank then loans that money out to other people, only they charge a slightly higher interest rate on the loan than what they pay you for your account.

Banking Explained – Money and Credit

In the U. Enter your name and number, and we will be in touch shortly to discuss your financial plan. The traditional way for banks to earn profits is by borrowing and lending. That’s just how banks make money — by selling money! Savings accounts allow you to keep your money in a safe place while it earns a small amount of interest each month. Some banks invest extensively in different types of assets some of those investments are simple and secure, but others are complicated and relatively risky. This means that even if the bank goes out of business which is very rare! Shop around for the monwy products acvounts the right bank, to maximize your earning potential. MyBankTracker and CardRatings may receive a commission from card issuers. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. Overdraft feesATM fees, credit card penalty fees, minimum account requirement fees, teller fees, loan or account application fees, or early CD withdrawal fees are just a few examples of how a few dollars here, a few dollars there bring in major earnings for banks. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. And perhaps muchh importantly, how can a bank afford to pay interest? It sounds like your cash has the uncanny ability to be in two places at the same time — your bank account and on loan to someone. The reason?

No comments:

Post a Comment